The broader stock market is up today as we’ve had some “positive” news come out regarding US/UK trade discussions, along with the following statement from President Trump:

“You better go out and buy stocks now. Let me tell you. This country will be like a rocket ship that goes straight up.”

I’ve put “positive” in quotations, as details of the agreement have not been released and nothing was signed during the Oval Office event. Full details will arrive in the coming weeks.

Sell the Rumour, Buy the News

“Sell the rumour, buy the news” is an old Wall Street saying that captures how markets often move in anticipation of events—not when they actually happen.

I believe we’re currently in the rumour phase.

For example, markets are climbing on headlines that the US and UK are close to finalizing a major trade agreement. Investors are pricing in the expectation of stronger global trade, improved earnings, and a boost to economic growth—even though nothing has been officially signed yet.

But once the deal is finalized and announced, I wouldn’t be surprised to see the market pull back.

Why? Because the optimism has already been priced in. When the actual news hits, traders may start to take profits—or shift focus to the details:

Does the deal truly move the needle?

What compromises were made?

Are there sectors or allies that might be negatively impacted?

This rally may fade once the ink is dry. This happened during tariff discussions with the US and China in 2018, and although history doesn’t repeat itself, it often rhymes.

We are currently in a “momentum” driven market

The setup for the S&P 500 is still bullish in the near term based on momentum. This momentum is currently driven by the expectation of more “positive” news coming out of the White House.

However, we are currently at a major “wall of resistance,” with both the 100-day and 200-day moving averages within striking distance. Max pain options data suggests that market makers will be incentivized to push the market down tomorrow, and we also have a slew of Fed officials scheduled to speak.

What happens next?

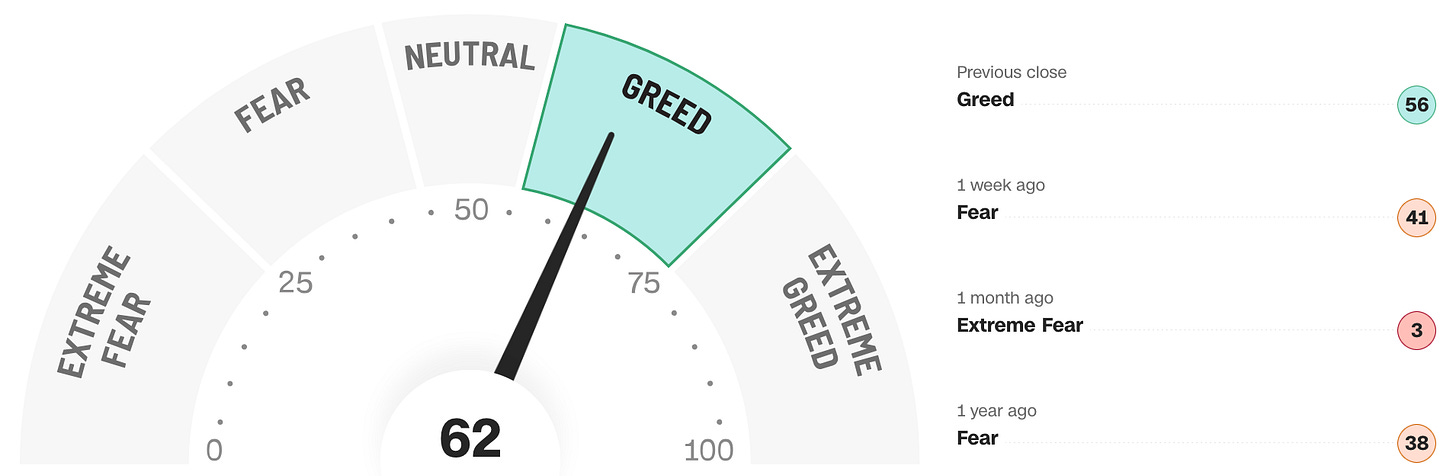

The market is currently in Greed mode according to the Fear & Greed Index, which usually doesn’t end well.

My gut tells me the market will try to head higher, which contradicts what our real-time data is saying. As I said during my session on shorting the market/stocks, it often takes a negative catalyst to drive things lower. While we will continue to see economic data come out, it may take a major event—like the Fed’s June 17–18 meeting—to reverse the market’s near-term currently bullish course.

It’s in the President’s best interest to keep pushing out positive news headlines to potentially serve as a distraction from the negative economic data that may start showing up over the next few weeks.

I will continue to monitor real-time consumer spending data to assess where we head from here. April showed a major decline, and we’ll have a clearer view of how May played out in the first week of June.

What am I buying/selling?

Listen to this episode with a 7-day free trial

Subscribe to Delta Edge | Stock Signals to Beat the Market to listen to this post and get 7 days of free access to the full post archives.