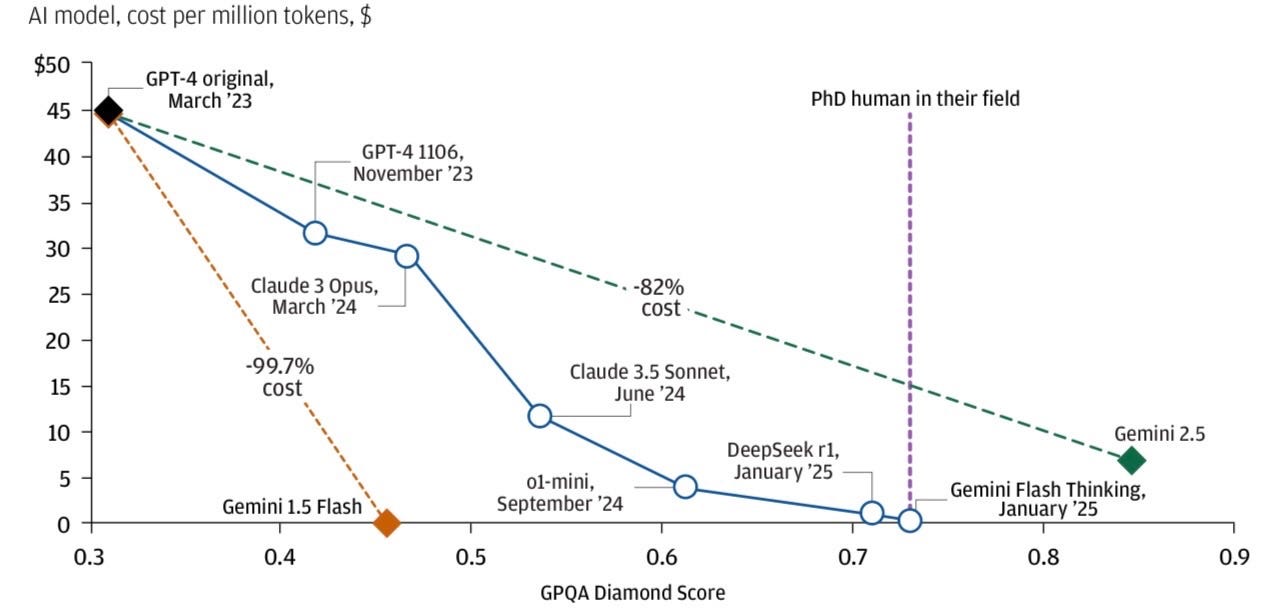

Compute Costs Are Plummeting

Let’s start with the chart:

Inference costs for large language models are falling fast — from dollars to cents per million tokens. What used to require elite infrastructure is now within reach for startups and solo devs.

This isn’t just a technical detail — it’s a foundational shift enabling the widespread adoption of AI across industries.

But here’s the twist:

Falling compute costs aren’t necessarily bearish for Nvidia. In fact, they could supercharge near-term demand.

Why Nvidia Still Wins (For Now)

Cheaper compute = more usage = more demand for infrastructure. Nvidia benefits in three key ways:

Massive Training Cycles Aren’t Going Away

Building GPT-5, Claude, or open-source competitors still needs clusters of H100s or Blackwells.

Enterprises are building their own frontier models — and they’re just getting started.

Datacenter Buildout Is Still Exploding

Cloud, sovereign AI, and even Fortune 500 companies are ramping up infrastructure spend.

Nvidia isn’t selling chips. They’re selling entire AI factories (HGX, DGX, networking, CUDA stack).

Platform Lock-In

Nvidia’s moat isn’t just hardware — it’s software (CUDA), ecosystem (Omniverse, AI Enterprise), and performance per watt.

As inference commoditizes, Nvidia becomes the picks-and-shovels layer of AI.

Earnings Preview: What to Watch

Expected numbers (Q1 FY2026):

Revenue: $24.6B

EPS: $5.59

Gross Margin: ~77%

Data Center Revenue: $21B+

Here’s what we’ll be watching beyond the headline numbers:

Key KPIs

Data center growth rate – Is it still accelerating? Any slowdown here = red flag.

Gross margins – Holding above 76–77% would signal strong pricing power.

China commentary – How much of a revenue hit from export restrictions? I think a lot of the “negativity” here is priced in, however.

Blackwell chip guidance – When will it ship? Is demand already booked?

Tone & Positioning

Are they confident and optimistic, or cautious?

Look for mentions of:

“visibility into 2026”

“pipeline remains strong”

“Blackwell demand exceeds supply”

How the Market Might React

If they beat and guide higher:

Expect a broad AI rally. Names like $SMCI, $AVGO, $AMD, $TSM, $PLTR, $PATH, and even $MSFT could run.

If they miss or guide flat:

AI stocks may sell off sharply — and it could signal a macro rotation into value names.

So What Do We Do?

I’m bullish on Nvidia — and here’s why:

MACD and RSI both show bullish continuation.

The pullback earlier this month gave us a chance to reset sentiment.

Nvidia remains the most important single stock in the AI megatrend.

My Checklist Heading Into Earnings:

✅ Watching for >$24.6B revenue

✅ Want to see >$21B data center revenue + margin >77%

✅ Looking for bullish tone re: Blackwell, enterprise demand, sovereign deals

Positioning:

I’m long. If it dips on cautious guidance, I’ll be buying more.

As compute costs fall, I believe will Nvidia continue to become the infrastructure powering that future and the demand curve just went exponential.

Good luck,

-Derrick

Share this post