06/15 - Momentum Stalls Ahead of the Fed (Pre-Market Update)

Markets Are Stalling. Fed on Deck. Oil Surging.

S&P 500 Level: 6000.36 | Near-Term Trend: Weakening

Key Levels to Watch: Resistance at 6030, 6100 | Support at 5920, 5850, 5775

Equities ended last week slightly positive on the surface, but momentum under the hood continues to fade. Breadth is narrowing, volatility is creeping back in, and the rally is losing energy.

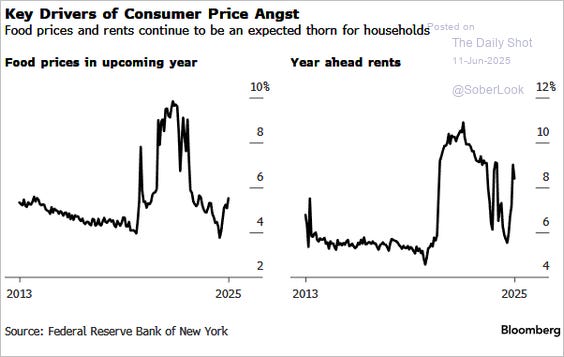

This week, all eyes turn to Tuesday’s retail sales report and the Federal Reserve’s interest rate decision on Wednesday. After last week’s soft CPI and PPI readings, the market appears optimistic that rate cuts are still on the table, but with oil prices spiking and geopolitical risks escalating, the Fed may strike a more cautious tone.

I believe we have topped - at least in the short term. The path of least resistance for now is lower, not higher.

Momentum Check: What the Charts Are Saying

The S&P 500 reclaimed the 6,000 level, but price action has grown choppy and indecisive.

RSI stalled near 64, showing fading momentum just below overbought levels

The index failed to push through 6030, the high from late May

Meanwhile, equal-weighted indices, small caps, and cyclicals continue to lag. This is not a broad-based rally - it’s being propped up by a shrinking group of large-cap tech names.

Unless we see a decisive breakout above 6100, I expect the market to drift lower, especially if macro data disappoints or the Fed pushes back on rate cut expectations.

Impact of Higher Oil Prices

WTI Crude: $73.47 | Weekly Change: +13.75%

The spike in oil prices following Israel’s strikes on Iran has reintroduced inflation concerns. While actual supply disruptions remain limited for now, the geopolitical premium is back.

Why this matters now:

Higher oil could reignite inflation pressures over the coming months

The Fed may view this as a reason to stay patient on cuts

Rising energy prices act as a tax on consumers — especially if retail sales come in soft on Tuesday

Markets have now scaled back to two expected cuts in 2025, but even that may prove aggressive if energy prices hold near current levels. The rebound in crude has quietly become one of the most important macro developments of the month.

Key Economic Data This Week

This week’s focus is on Tuesday’s retail sales and, more importantly, Wednesday’s FOMC rate decision.

Retail sales may show a modest rebound, but it’s likely driven by short-term factors like higher gas prices and auto demand, not a meaningful shift in consumer strength.

The Fed decision, however, could reshape market expectations. With inflation cooling but oil rising, investors are watching for any shift in the dot plot or Powell’s tone.

Rate cut expectations are central to equity valuations and sentiment. A more hawkish stance, even without a hike, could pressure stocks, yields, and risk

Tuesday — U.S. Retail Sales (May):

Retail sales are expected to bounce in May, but this likely reflects a one-off pull-up in consumer spending, rather than a durable trend.

Gas prices were higher, auto sales rebounded modestly, and promotional activity picked up, all of which could make the number look stronger than it really is. But from a market perspective, this print probably won’t move the needle much.

The broader reality hasn’t changed:

Real disposable income is flatlining

Credit card delinquencies are rising

Consumers are becoming more selective, not more aggressive

Unless retail sales are wildly above or below expectations, I don’t expect much market impact.

Wednesday — FOMC Rate Decision + Powell Press Conference:

No rate cut expected

Markets will be focused on the updated dot plot, growth forecasts, and inflation language

If Powell pushes back on market optimism, expect a repricing across equities and bonds

Together, this data will clarify whether the U.S. economy is still humming or if cracks are starting to form under the surface.

Final Thoughts: Positioning Through the Noise

Keep reading with a 7-day free trial

Subscribe to Delta Edge | Stock Signals to Beat the Market to keep reading this post and get 7 days of free access to the full post archives.